This booklet provides instructions for completing Form 100, California Corporation Franchise or Income Tax Return. References in these instructions are to the Internal Revenue Code (IRC) as of January 1, 2015, and to the California Revenue and Taxation Code (RTC).

The instructions provided with California tax forms are a summary of California tax law and are only intended to aid taxpayers in preparing their state income tax returns.

Introduction

Form 100 is the California Corporation Franchise or Income Tax Return. It is used by corporations to report their income and franchise tax liability to the California Franchise Tax Board (FTB). This form is required to be filed annually by all corporations that are doing business in California, regardless of whether they are incorporated in California or another state.

The Form 100 instructions provide detailed information on how to complete the form, including guidance on reporting income, deductions, credits, and payments. The instructions also explain the various tax rates and filing requirements that apply to corporations in California.

It is important to note that the instructions provided with California tax forms are a summary of California tax law and are only intended to aid taxpayers in preparing their state income tax returns. Taxpayers should consult with a qualified tax professional if they have any questions about the instructions or their specific tax situation.

Filing Requirements

Corporations filing Form 100, California Corporation Franchise or Income Tax Return, including combined reports and certain accompanying forms and schedules, must meet specific filing requirements. These requirements ensure accurate and timely reporting of tax liabilities.

The filing deadline for Form 100 is the 15th day of the fourth month after the close of the taxable year. For example, the deadline for filing a return for the 2023 tax year is April 15, 2024. However, if the corporation’s taxable year ends on a date other than December 31, the filing deadline will be adjusted accordingly.

Corporations may be eligible for an automatic extension to file their return, but they must still pay any taxes owed by the original due date. The extension period is typically six months, extending the filing deadline to October 15. Corporations can request an automatic extension by filing Form 3539, Automatic Extension for Corporations.

Taxable Entities

The California Franchise Tax Board (FTB) defines specific entities as taxable under California corporation tax law. Understanding these classifications is crucial for determining if a business needs to file Form 100.

A limited liability company (LLC) classified as an association taxable as a corporation for federal purposes must file Form 100. This classification means the LLC is treated as a corporation for California tax purposes, subject to the state’s corporation tax law.

Additionally, corporations that are unitary in nature can elect to file a combined return using Form 100 or Form 100W, Waters-Edge Filers. The election is made on Schedule R-7, Election to File a Unitary Taxpayers Group Return. The return must present the group’s data by separate corporation, as well as the entire amount of unitary business income.

Combined Reports

California corporations that are unitary in nature have the option to file a combined report, which consolidates the financial data of multiple affiliated companies under a single tax return. This approach is particularly relevant for businesses operating across various states or countries, where a unitary business is defined as a group of companies that are so closely connected that they function as a single economic unit.

Filing a combined report allows businesses to allocate income and expenses among the affiliated entities based on their individual contributions to the overall business activity. This can potentially result in a lower overall tax liability for the group as a whole.

The decision to file a combined report is made by the corporation and requires careful consideration of various factors, including the nature of the business, the structure of the group, and the applicable tax laws. It’s essential to consult with tax professionals to determine if filing a combined report is advantageous for your specific situation.

Statement of Information

The Statement of Information (Form SI-100) is a crucial document required by the California Secretary of State for corporations registered in the state. This form serves as an official record of the corporation’s essential information, including its name, address, and contact details. It’s essential to ensure that the information provided on this form is accurate and up-to-date.

Corporations are obligated to file an initial Statement of Information within 90 days of incorporation and subsequently file updates every two years. Additionally, any significant changes to the corporation’s information, such as a change of address or officers, must be reported within 30 days of the change.

Failing to file the required Statement of Information can result in penalties, including fines and potential legal action. Filing online at the California Secretary of State’s website is the fastest and most convenient method to ensure timely and accurate submission.

Payment Instructions

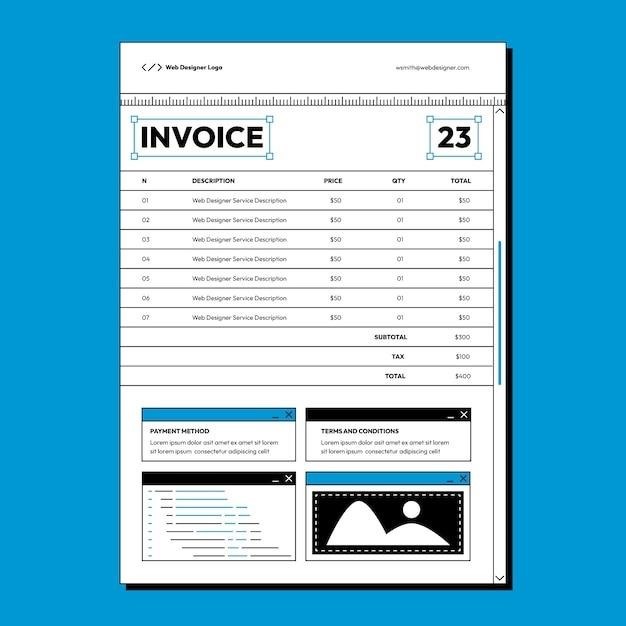

When filing Form 100, California Corporation Franchise or Income Tax Return, taxpayers must adhere to specific payment instructions. The Franchise Tax Board (FTB) offers various payment methods, allowing corporations to choose the most convenient option.

One common method is to make payments via mail using a check or money order. These payments should be made payable to the “Franchise Tax Board” and include the corporation’s tax identification number and the year of the return.

Alternatively, corporations can utilize online payment options through the FTB’s website. This method allows for secure and efficient payments using a debit card, credit card, or electronic funds transfer. The online payment platform offers convenience and real-time confirmation of payment.

The FTB also accepts payments made through authorized tax preparation software or through a tax professional. These options provide additional flexibility and convenience for taxpayers. Regardless of the chosen payment method, it’s crucial to ensure that payments are made on time to avoid penalties and interest charges.

Tax Filing Deadlines

California corporations have specific deadlines for filing their franchise or income tax returns, which are outlined in the instructions for Form 100. These deadlines are crucial for corporations to avoid penalties and ensure compliance with California tax regulations.

Generally, the original due date for filing Form 100 is the 15th day of the fourth month after the close of the taxable year. For example, if the corporation’s taxable year is a calendar year (January 1 to December 31), the original due date would be April 15th of the following year.

However, the FTB may grant an automatic extension for filing the return. This extension typically extends the filing deadline to the 15th day of the 11th month after the close of the taxable year.

It’s important to note that while an extension may be granted for filing, it does not extend the payment deadline. Corporations are still required to pay any taxes owed by the original due date.

Form 100-ES⁚ Estimated Tax

Form 100-ES, California Corporation Estimated Tax, is used by corporations to make quarterly payments of estimated income tax throughout the year. This helps to ensure that corporations pay their taxes on a timely basis and avoid penalties for underpayment. The estimated tax payments help to spread out the tax burden over the year, making it easier for corporations to manage their cash flow.

Corporations are required to file Form 100-ES if they anticipate owing a certain amount of tax. The specific requirements for filing Form 100-ES depend on the corporation’s income and tax liability. The instructions for Form 100-ES provide detailed guidance on the requirements for filing and making estimated tax payments.

The estimated tax payments are made on a quarterly basis, with the due dates typically falling on the 15th day of the 4th, 6th, 9th, and 12th months of the taxable year. Corporations can make their estimated tax payments online, by mail, or by phone.

Form 100-S⁚ S Corporation Return

Form 100-S, California S Corporation Franchise or Income Tax Return, is used by S corporations to report their income, deductions, and credits for the taxable year. This form is designed to capture the specific tax information relevant to S corporations, which are pass-through entities, meaning that their income and losses are passed through to their shareholders and reported on their individual tax returns.

S corporations are subject to a franchise tax, which is calculated based on their income and the number of shares outstanding. Form 100-S allows S corporations to report their income and expenses, compute their franchise tax liability, and make any necessary payments to the California Franchise Tax Board.

The instructions for Form 100-S provide detailed guidance on completing the form, including specific instructions for reporting various types of income and deductions, as well as for calculating the franchise tax liability. The instructions also provide information on filing deadlines, penalties for late filing, and other important details related to S corporation tax compliance in California.

Form 100-W⁚ Waters-Edge Election

Form 100-W, California Corporation Franchise or Income Tax Return, is specifically designed for corporations that have elected to use the Waters-Edge election for their California tax purposes. This election allows corporations that are part of a multinational business group to exclude income from non-U.S. operations from their California franchise tax base.

The Waters-Edge election essentially creates a “waters-edge” around the corporation’s operations, meaning that only income derived from activities within the United States is subject to California franchise tax. This election is beneficial for corporations with significant international operations, as it can reduce their overall tax liability in California.

Form 100-W includes specific sections for reporting income and expenses related to both U.S. and non-U.S. operations. It also requires corporations to provide details about their international activities and to demonstrate that they meet the requirements for the Waters-Edge election. The instructions for Form 100-W provide detailed guidance on completing the form and on making the Waters-Edge election.