Letter of Instruction Template Bank⁚ A Comprehensive Guide

This guide provides a comprehensive overview of bank letter of instruction templates‚ covering their purpose‚ key elements‚ and best practices․ It explores various scenarios requiring such letters‚ including wire transfers and account management‚ emphasizing the importance of clarity‚ accuracy‚ and legal considerations․ Examples and sample templates illustrate how to effectively structure these crucial documents for seamless bank transactions․ Learn how to avoid ambiguity and ensure your instructions are precisely understood by the bank․ This guide also addresses the use of bank-specific forms and the significance of proper signatures for legal validity․

Understanding the Purpose of a Letter of Instruction

A Letter of Instruction (LOI) to a bank serves as a formal communication outlining specific directives for banking transactions or account management․ It’s a crucial document providing precise‚ unambiguous instructions to the bank‚ ensuring that actions are taken exactly as intended by the account holder․ This eliminates potential misunderstandings and ensures the smooth execution of financial operations․ The LOI’s primary purpose is to safeguard against errors and protect the client’s interests by documenting all necessary details in writing․ The level of detail required depends on the complexity of the transaction; for straightforward requests‚ a concise letter may suffice‚ while more intricate operations warrant a more comprehensive document․ Regardless of complexity‚ clarity and accuracy are paramount to avoid delays or incorrect processing․ Banks frequently utilize their own forms‚ but a well-drafted letter can complement or even replace these forms‚ ensuring that all instructions are clear and legally sound․

Key Elements of an Effective Letter of Instruction

An effective Letter of Instruction (LOI) to a bank must include several key components to ensure clarity and prevent misinterpretations․ Crucially‚ it should begin with a clear and concise statement of purpose‚ specifying the desired action․ Accurate account details are essential‚ including the account holder’s full name‚ account number‚ and type of account (e․g․‚ checking‚ savings)․ Beneficiary information‚ if applicable‚ needs to be precise and complete‚ including full name‚ address‚ and account number․ Specific instructions should be detailed and unambiguous‚ leaving no room for doubt about the desired outcome․ For example‚ when instructing a wire transfer‚ the exact amount‚ currency‚ and intended recipient’s banking details must be clearly stated․ The LOI should also include the date of issuance and the authorized signatory’s signature‚ ideally witnessed․ Finally‚ contact information for the account holder is vital to facilitate communication and clarification if needed․ The use of formal language and a professional tone throughout the letter maintains a formal and respectful business communication style․

Sample Letter of Instruction for Bank Transactions

To Whom It May Concern at [Bank Name]‚

This letter serves as formal instruction for a wire transfer from my account․ My account details are as follows⁚ Account Name⁚ [Your Full Name]‚ Account Number⁚ [Your Account Number]‚ Account Type⁚ [Savings/Checking]․ I request a wire transfer of [Amount] in [Currency] to the following beneficiary⁚ Beneficiary Name⁚ [Beneficiary Full Name]‚ Beneficiary Bank⁚ [Beneficiary Bank Name]‚ Beneficiary Account Number⁚ [Beneficiary Account Number]‚ SWIFT Code⁚ [SWIFT Code]․ The purpose of this transfer is [briefly state purpose]․ Please confirm the successful completion of this transaction via email to [Your Email Address] or by phone at [Your Phone Number]․ I understand that all bank fees associated with this transfer will be deducted from my account․ I authorize this transaction and confirm the accuracy of the information provided․ Please retain a copy of this letter for your records․ Sincerely‚ [Your Signature]‚ [Your Typed Name]‚ [Date]․ This is a sample; adjust as needed for specific transactions like account closures or stop payments․

Specific Instructions⁚ Wire Transfers and Account Management

Wire transfers require precise details․ Include the full name and account number of both the sender and recipient․ Specify the currency and amount․ For international transfers‚ provide the SWIFT code and the recipient’s bank address․ Confirm the transfer purpose to comply with anti-money laundering regulations․ Account management instructions might include requests for statement copies‚ address changes‚ or adding authorized users․ Clearly state the desired action and provide all necessary information‚ such as new addresses or the names and details of authorized individuals․ Attach supporting documents if required‚ like identification or proof of address․ Always maintain a copy of the letter for your records․ Remember to use formal language and maintain a professional tone throughout the letter․ Double-check all details for accuracy before sending to avoid delays or errors․ Consider using a template to ensure consistency and completeness․ Confirm your instructions by phone with a designated bank representative if needed․

Addressing Account Details and Beneficiary Information

Accuracy in providing account and beneficiary details is paramount when issuing a letter of instruction to your bank․ For your own account‚ clearly state the full account number‚ type of account (checking‚ savings‚ etc․)‚ and the name exactly as it appears on your bank records․ Any discrepancies can lead to delays or rejection of your instruction․ Regarding the beneficiary‚ provide their full legal name‚ address‚ and account number (if applicable) with meticulous precision․ For international transfers‚ the beneficiary’s bank details‚ including the SWIFT code and full bank address‚ are crucial․ If the beneficiary is a company‚ include the company’s registered name and address‚ along with any relevant registration numbers․ Double-check all information against official documents to avoid errors․ Using a template can help ensure all necessary fields are completed accurately․ Remember to maintain copies of the letter and supporting documentation for your records‚ providing a verifiable audit trail for any future inquiries․

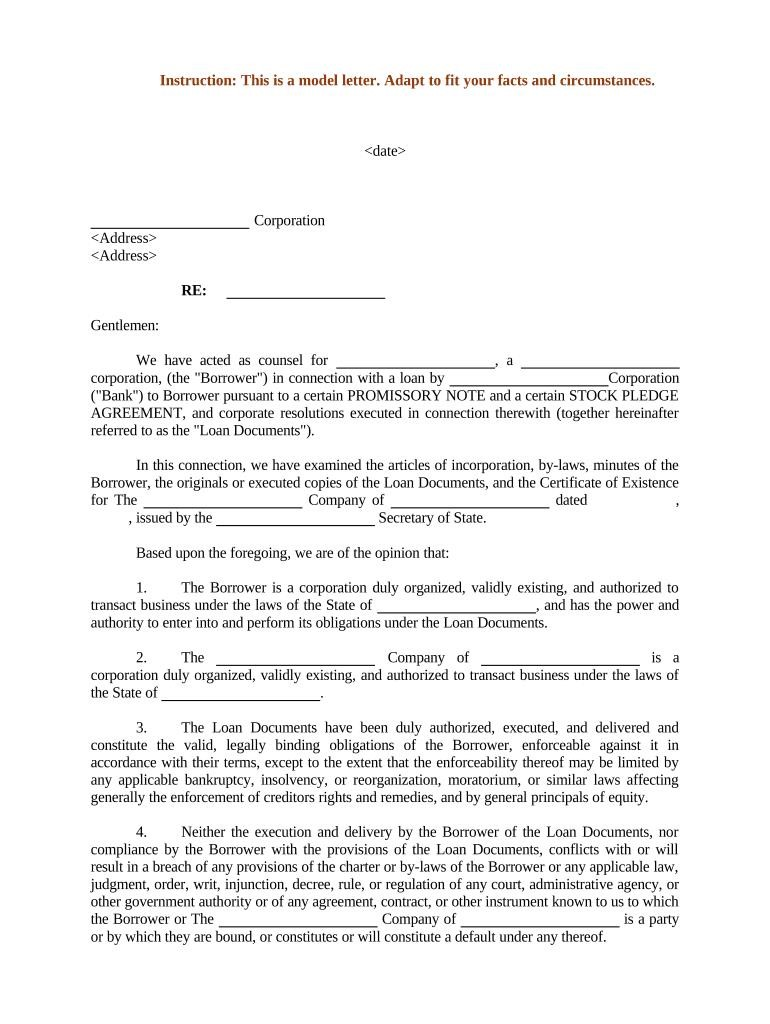

Legal Considerations and Best Practices

Legal compliance is crucial when drafting a letter of instruction for banking transactions․ Ensure the letter is unambiguous‚ using clear and concise language to avoid any misinterpretations that could lead to legal disputes․ Specify the exact amount‚ currency‚ and purpose of the transaction․ For significant transactions‚ seeking legal counsel is advisable to ensure compliance with relevant regulations and to protect your interests․ Maintain a copy of the letter and any supporting documents for your records․ Consider using a secure method of delivery‚ such as registered mail‚ to provide proof of delivery and receipt․ If dealing with sensitive information like large sums of money or personal data‚ prioritize confidentiality and data security․ Some banks may have specific forms or templates that need to be used; checking with your bank beforehand is essential․ Always retain a copy of the signed and delivered letter for your records․ Familiarize yourself with your bank’s terms and conditions‚ and adhere to any specified procedures for instructions․

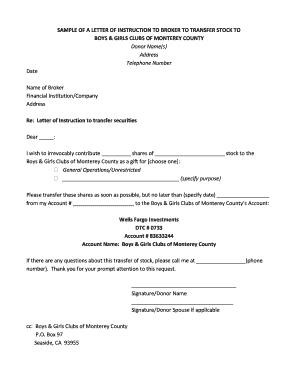

Using Bank-Specific Forms and Templates

Many banks provide their own standardized forms and templates for letters of instruction․ Utilizing these pre-approved formats ensures compliance with the bank’s internal procedures and minimizes the risk of errors or delays in processing your instructions․ These templates often include all the necessary fields and sections required by the bank‚ simplifying the process and reducing the chance of missing crucial information․ Using a bank-specific form demonstrates your awareness of and adherence to their protocols‚ which can improve efficiency and communication․ Check with your bank’s customer service or website to obtain the appropriate form․ Downloading and completing the form online may offer additional convenience and ensure accuracy․ If you are unsure about completing any section of the bank’s form‚ contact your bank’s customer support for assistance․ Remember to always review the completed form before submission to verify all details are correct and accurate‚ avoiding potential complications or delays in processing your request․

Ensuring Clarity and Avoiding Ambiguity

Precision is paramount when drafting a letter of instruction for your bank․ Ambiguity can lead to delays‚ errors‚ and even financial losses․ Use clear‚ concise language‚ avoiding jargon or technical terms that might be misinterpreted․ Specify the exact amount of any transaction‚ the intended recipient’s full name and accurate account details‚ and the purpose of the instruction․ Employ unambiguous phrasing; for example‚ instead of “approximately $10‚000‚” state the precise amount⁚ “$10‚000․00․” Double-check all figures and account numbers for accuracy․ If you’re unsure about any terminology or procedure‚ consult your bank’s resources or contact their customer service department for clarification before submitting your letter․ A well-written letter leaves no room for misinterpretation‚ ensuring your instructions are carried out flawlessly and efficiently․ Review your letter meticulously before sending to identify and correct any potentially ambiguous phrasing․ Consider having a second person review your draft before finalizing and submitting it to your bank․

Importance of Accurate Information and Signatures

The accuracy of information provided in a bank letter of instruction is critical․ Inaccuracies can lead to significant delays‚ incorrect transactions‚ and potential financial losses․ Double-check all account numbers‚ beneficiary details‚ amounts‚ and transaction types before submitting the letter․ Ensure all names are spelled correctly and that addresses are complete and accurate․ Verify the currency used for international transactions․ Using the correct account number is paramount to ensure funds are transferred to the intended recipient․ Any discrepancies can result in significant delays or the funds being sent to the wrong account․ Legible signatures are also essential․ The letter should be signed by the authorized account holder(s)‚ ensuring the bank verifies the authenticity of the instruction․ Banks often require specific signature formats or may request additional verification․ Adhering to the bank’s requirements ensures a smooth and efficient processing of your request․ Failure to provide accurate information or a valid signature could lead to the rejection of your instruction․

Potential Scenarios Requiring a Letter of Instruction

Numerous situations necessitate a formal letter of instruction to your bank․ These range from straightforward transactions to more complex financial maneuvers․ Wire transfers‚ often involving significant sums of money across borders‚ demand precise instructions to prevent errors․ Managing multiple accounts might require instructions detailing specific actions for each․ Similarly‚ initiating standing orders or direct debits necessitates clear directives to the bank regarding the amounts‚ frequencies‚ and recipient details․ Letters of instruction can also be crucial for estate planning‚ outlining post-mortem instructions for account access or distribution․ Account closures may require a formal letter detailing the desired method of funds transfer or account balance disposition․ In cases of lost or stolen cards‚ a letter of instruction may be required to report the loss‚ block access‚ and request replacements․ Furthermore‚ some banks require letters of instruction for certain types of investment transactions or for accessing specific account features․ The need for a letter often arises when a standard online banking interface doesn’t fully cover the required action or added security is needed․